Overview of Final Budget for Fiscal Year:

Final Budget

| 2022-23 Final | 2023-24 Final | Change | |

|---|---|---|---|

| All Funds | |||

| Budget | $3,798,366,989 | $4,106,531,009 | $308,164,020 |

| Full Time Equivalent Positions | 10,370.33 | 10,399.80 | 29.47 |

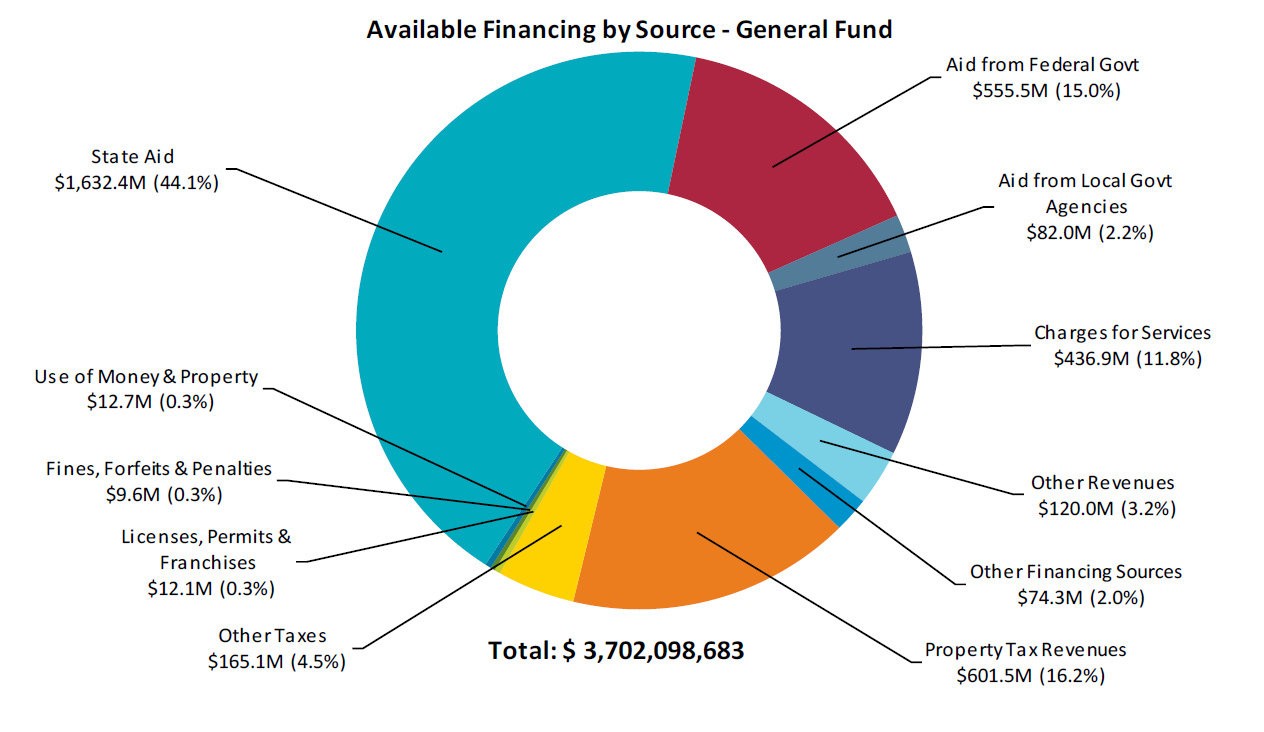

| General Fund* | |||

| Budget | $3,489,926,290 | $3,702,098,683 | $212,172,393 |

| Full Time Equivalent Positions | 8,486.49 | 8,484.89 | (1.60) |

Appropriations(Expenditures + Contingency + Designation) = TOTAL = Revenue(AFB* + Revenue + Designation Cancellation + Property Taxes)

| Fund | Expenditure Requirements |

Contingency | Designation | Total | AFB* | Miscellaneous Revenue |

Designation Cancellation |

Property Taxes |

|---|---|---|---|---|---|---|---|---|

| General Fund | $3,568.49 | $103.61 | $30.00 | $3,702.10 | $0.00 | $3,050.47 | $50.08 | 601.55 |

| Capital Funds | $118.49 | $0.00 | $0.00 | $118.49 | $19.04 | $99.46 | $0.00 | $0.00 |

| Fish and Game Fund |

$0.06 | $0.00 | $0.00 | $0.06 | $0.00 | $0.06 | $0.00 | $0.00 |

| Road Fund | $153.56 | $0.00 | $0.00 | 153.56 | $45.83 | $107.73 | $0.00 | $0.00 |

| Library Fund | $44.25 | $0.00 | $0.00 | $44.25 | $6.78 | $7.04 | $0.00 | $30.43 |

| Library Special Tax Zone |

$0.63 | $0.00 | $0.00 | $0.63 | $0.00 | $0.01 | $0.00 | $0.62 |

| Property Development Fund |

$40.59 | $0.00 | $0.00 | $40.59 | $0.00 | $40.59 | $0.00 | $0.00 |

| Measure A1 Fund |

$46.87 | $0.00 | $0.00 | $46.87 | $0.00 | $46.87 | $0.00 | $0.00 |

| Total All Funds | $3,972.92 | 103.61 | $30.00 | $4,106.53 | $71.64 | $3,352.21 | $50.08 | $632.60 |

* Available Fund Balance

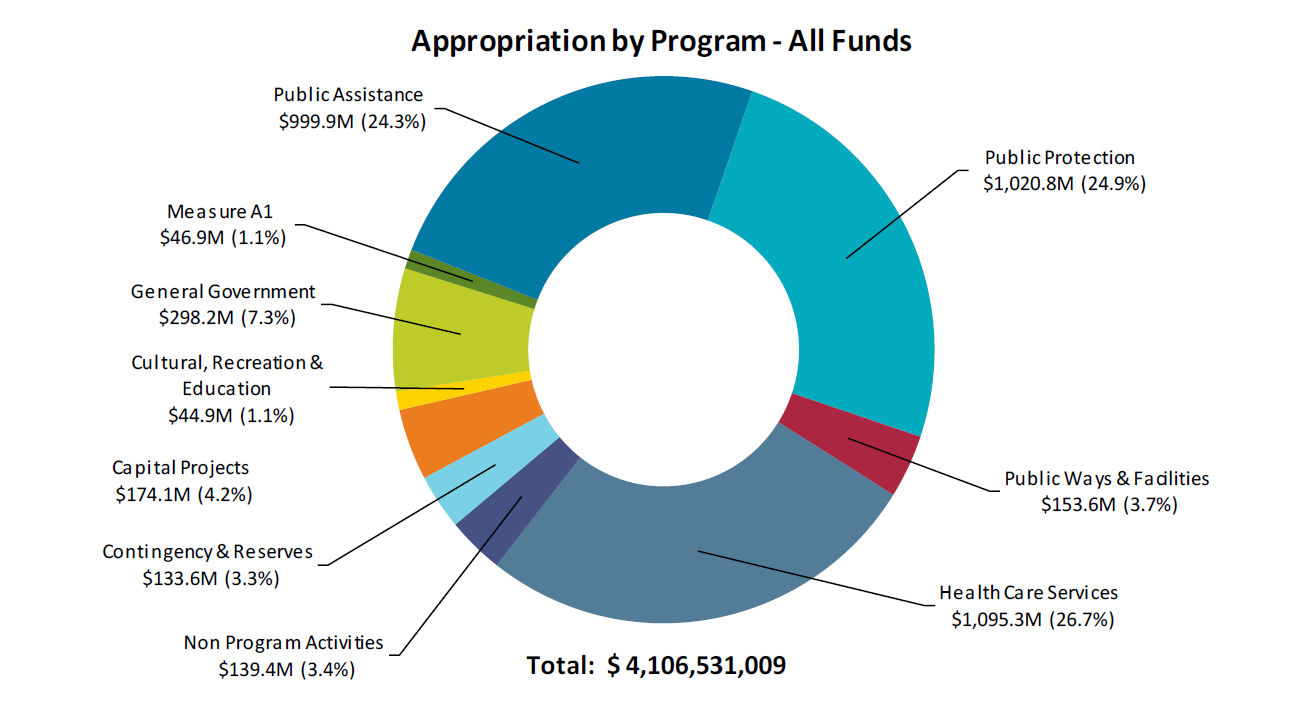

Appropriation by Program

| Program | General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Appropriations | Percent of Total |

|---|---|---|---|---|---|---|---|---|---|---|

| Capital Projects | $15,000,000 | $0 | $0 | $0 | $0 | $40,585,506 | $118,493,550 | $0 | 174,079,056 | 4.2% |

| Cultural, Recreation & Education | $0 | $0 | $0 | $44,245,440 | $626,642 | $0 | $0 | $0 | $44,872,082 | 1.1% |

| General Government | $298,227,883 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $298,227,883 | 7.3% |

| Measure A1 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $46,866,072 | $46,866,072 | 1.1% |

| Public Assistance | $999,923,698 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $999,923,698 | 24.3% |

| Public Protection | $1,020,711,075 | $60,000 | $0 | $0 | $0 | $0 | $0 | $0 | $1,020,771,075 | 24.9% |

| Public Ways & Facilities | $0 | $0 | $153,555,116 | $0 | $0 | $0 | $0 | $0 | $153,555,116 | 3.7% |

| Health Care Services | $1,095,275,965 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $1,095,275,965 | 26.7% |

| Non Program Acitvities | $139,353,951 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $139,353,951 | 3.4% |

| Contingency & Reserves | $133,606,111 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $133,606,111 | 3.3% |

| Budget Total | $3,702,098,683 | $60,000 | $153,555,116 | $44,245,440 | $626,642 | $40,585,506 | $118,493,550 | $46,866,072 | $4,106,531,009 | 100.0% |

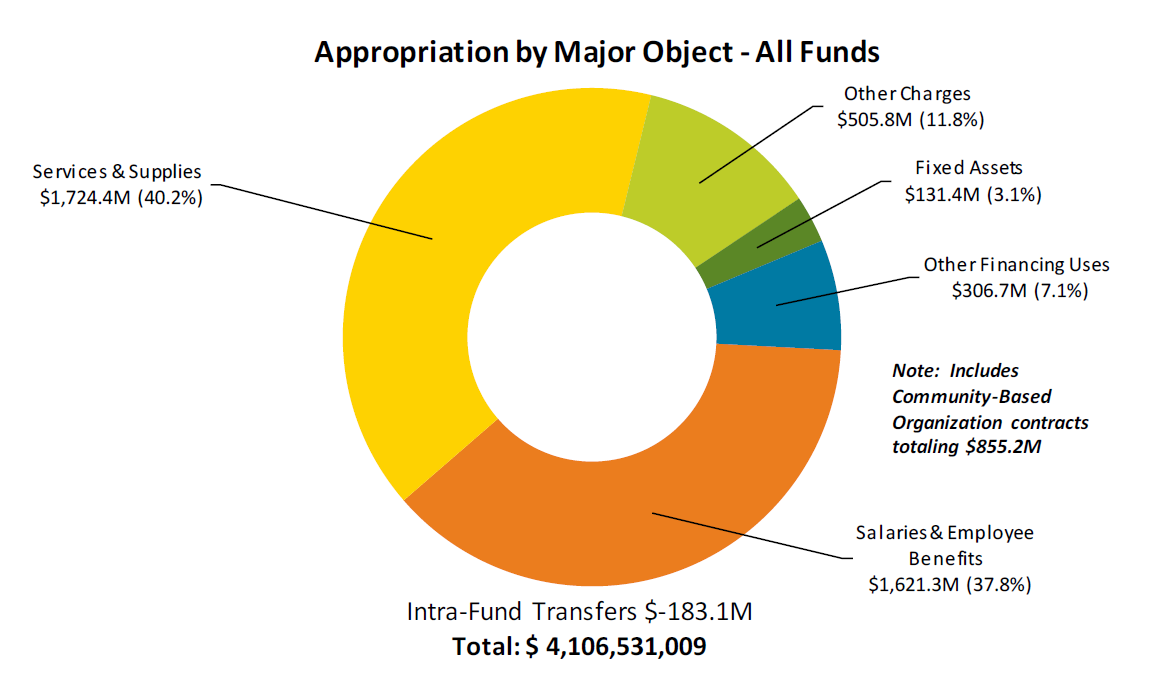

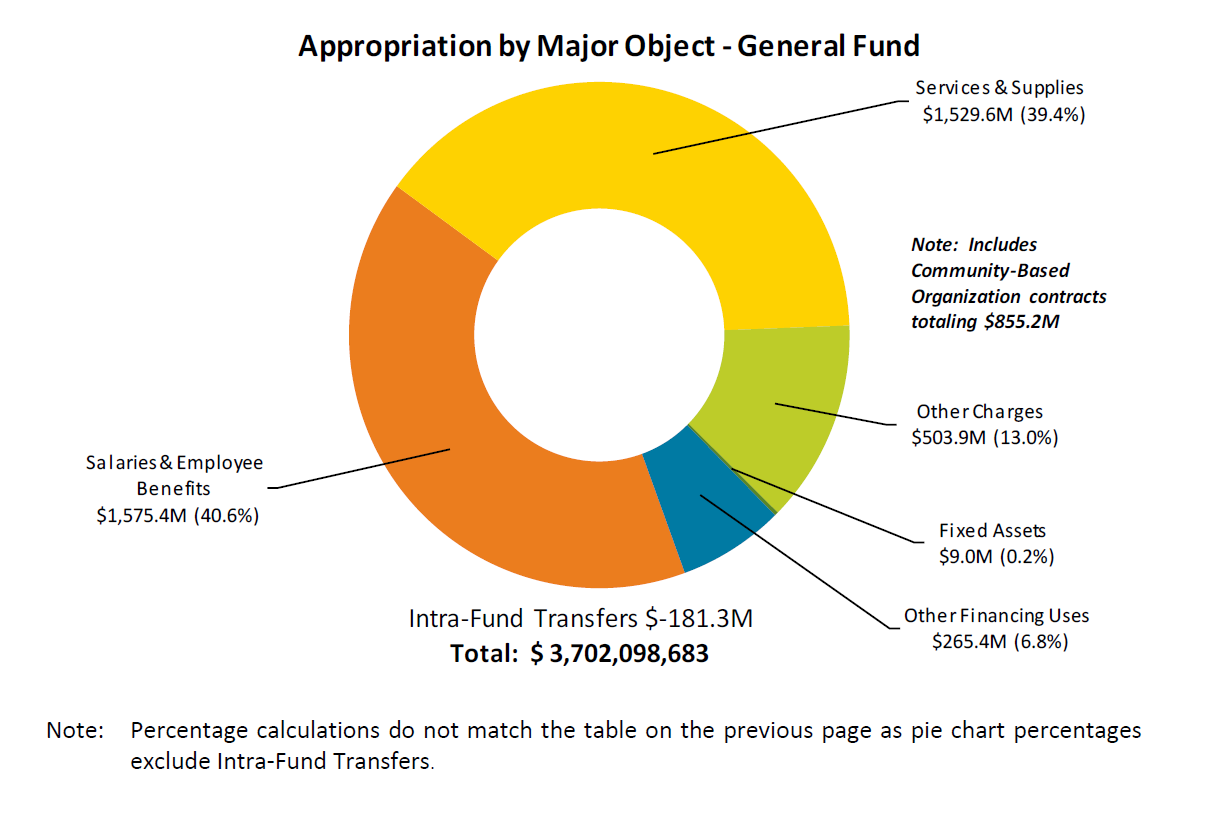

Appropriation by Major Object

| General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Appropriations | Percent of Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| Salaries & Employee Benefits | $1,575,410,111 | $0 | $17,764,956 | $27,526,801 | $0 | $605,307 | $0 | $0 | $1,621,307,175 | 39.5% |

| Services & Supplies | $1,529,624,583 | $60,000 | $131,537,354 | $14,851,782 | $621,404 | $853,461 | $0 | $46,866,072 | $1,724,414,656 | 42.0% |

| Other Charges | $503,902,802 | $0 | $1,022,806 | $866,857 | $5,238 | $0 | $0 | $0 | $505,797,703 | 12.3% |

| Fixed Assets | $9,048,439 | $0 | $2,555,000 | $1,000,000 | $0 | $500,000 | $118,338,550 | $0 | $131,441,989 | 3.2% |

| Intra-Fund Transfer | ($181,260,288) | $0 | ($1,825,000) | $0 | $0 | $0 | $0 | $0 | ($183,085,288) | -4.5% |

| Contingency | $103,606,111 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $103,606,111 | 2.5% |

| Other Financing Uses | $131,766,925 | $0 | $2,500,000 | $0 | $0 | $38,626,738 | $155,000 | $0 | $173,048,663 | 4.2% |

| Reserve/Designation | $30,000,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $30,000,000 | 0.7% |

| Budget Total | $3,702,098,683 | $60,000 | 153,555,116 | $44,245,440 | $626,642 | $40,585,506 | $118,493,550 | $46,866,072 | $4,106,531,009 | 100% |

Note: Totals may vary slightly due to rounding.

* The General Fund Services & Supplies appropriation includes $ million in funding for Community-Based Organization contracts. See the “Community-Based Organization Contracts” section of the Appendix for more details.

** Examples of Other Charges include direct benefit payments, indigent expenses, interest payments, taxes/assessments, settlement of claims, and depreciation.

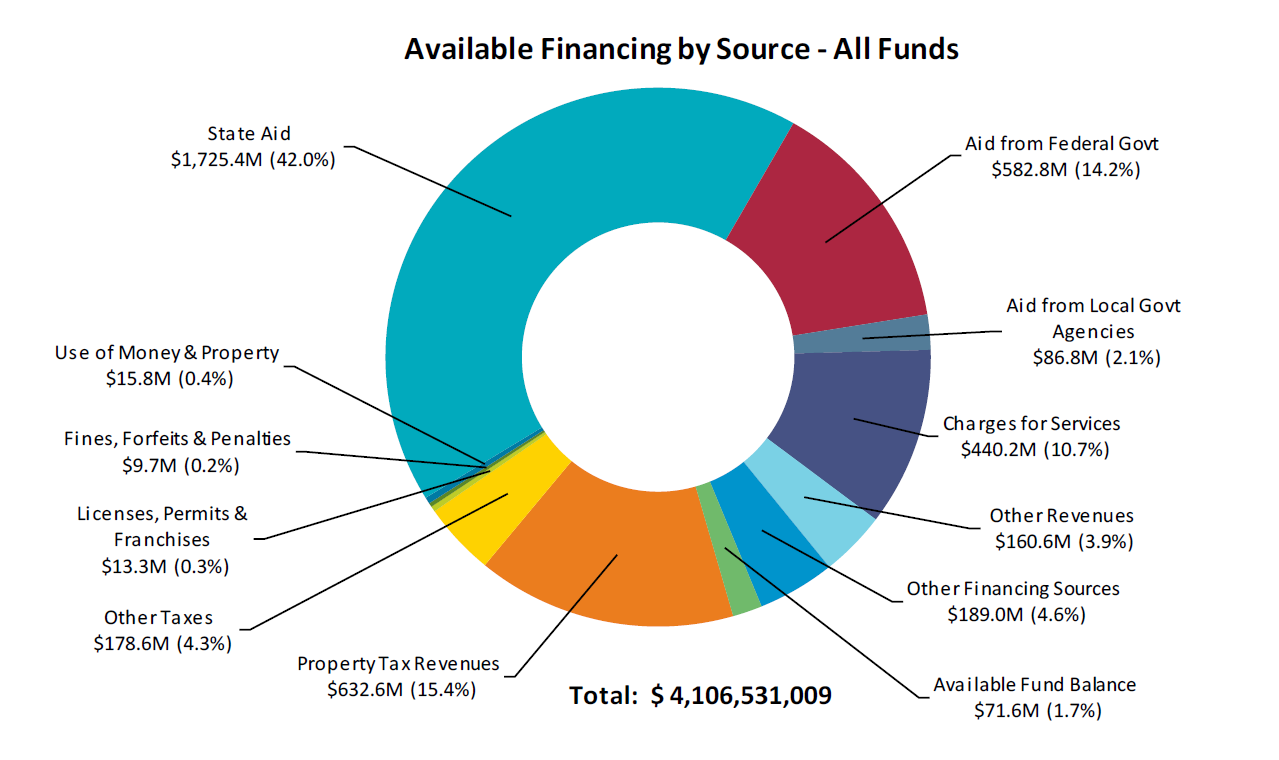

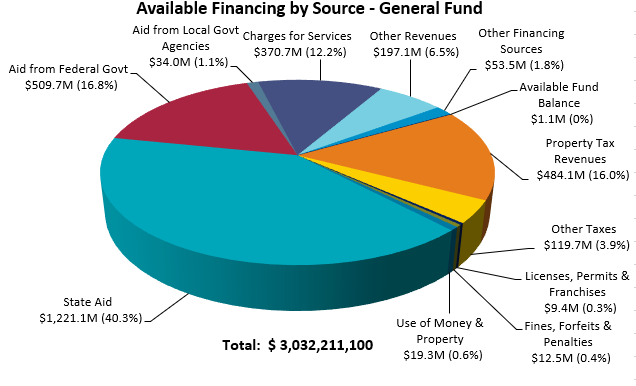

Total Available Financing by Source

| General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Financing | Percent of Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| Property Tax Revenues | $601,546,231 | $0 | $0 | $30,432,794 | $618,292 | $0 | $0 | $0 | $632,597,317 | 15.4% |

| Other Taxes | $165,060,649 | $0 | $10,443,000 | $3,078,245 | $350 | $0 | $0 | $0 | $178,582,244 | 4.3% |

| Licenses, Permits & Franchises | $12,135,272 | $0 | $1,214,426 | $0 | $0 | $0 | $0 | $0 | $13,349,698 | 0.3% |

| Fines, Forfeits & Penalties | $9,602,631 | $59,900 | $25,000 | $0 | $0 | $0 | $0 | $0 | $9,687,531 | 0.2% |

| Use of Money & Property | $12,730,437 | $100 | $2,825,000 | $100,000 | $5,000 | $155,506 | $0 | $0 | $15,816,043 | 0.4% |

| State Aid | $1,632,368,841 | $0 | $61,288,421 | $150,000 | $3,000 | $0 | $31,611,500 | $0 | $1,725,421,762 | 42.0% |

| Aid from Federal Government | $555,505,748 | $0 | $27,267,500 | $0 | $0 | $0 | $0 | $0 | $582,773,248 | 14.2% |

| Aid from Local Government Agencies | $82,047,276 | $0 | $3,795,000 | $975,000 | $0 | $0 | $0 | $0 | $86,817,276 | 2.1% |

| Charges for Services | $436,881,604 | $0 | $829,700 | $2,523,696 | $0 | $0 | $0 | $0 | $440,235,000 | 10.7% |

| Other Revenues | $119,964,931 | $0 | $39,200 | $210,000 | $0 | $40,430,000 | $0 | $0 | $160,644,131 | 3.9% |

| Other Financing Sources | $74,255,063 | $0 | $0 | $0 | $0 | $0 | $67,843,852 | $46,866,072 | $188,964,987 | 4.6% |

| Available Fund Balance | $0 | $0 | $45,827,869 | $6,775,705 | $0 | $0 | $19,038,198 | $0 | $71,641,772 | 1.7% |

| Budget Total | $3,702,098,683 | $60,000 | $153,555,116 | $44,245,440 | $626,642 | $40,585,506 | $118,493,550 | $46,866,072 | $4,106,531,009 | 100% |

Note: Totals may vary slightly due to rounding.

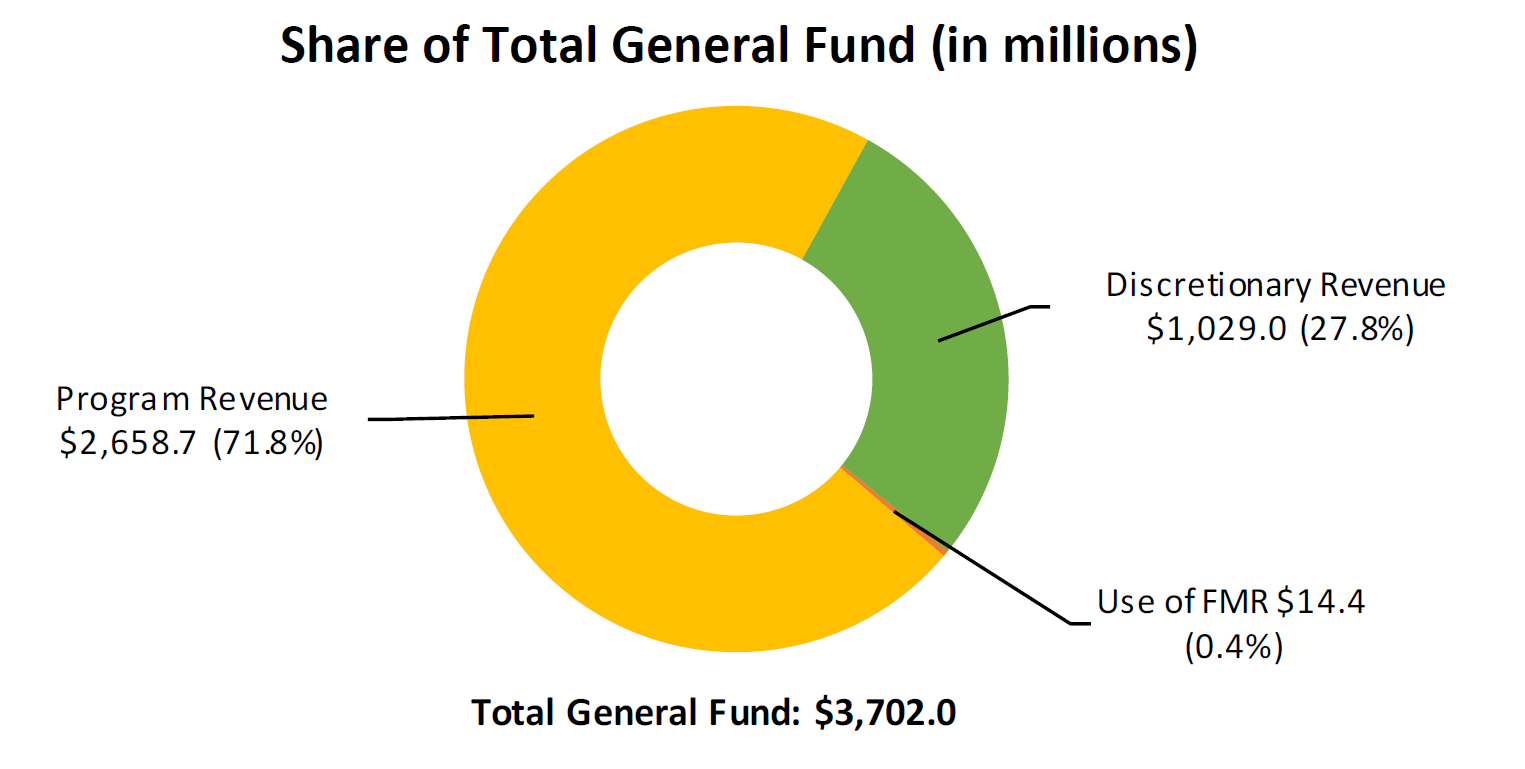

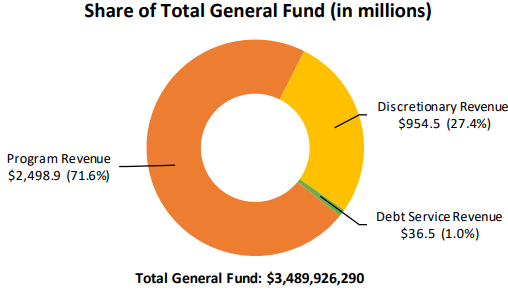

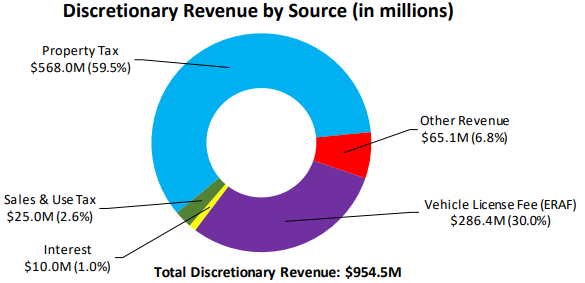

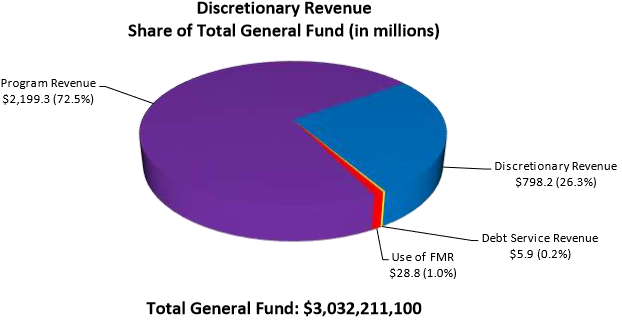

Discretionary Revenue

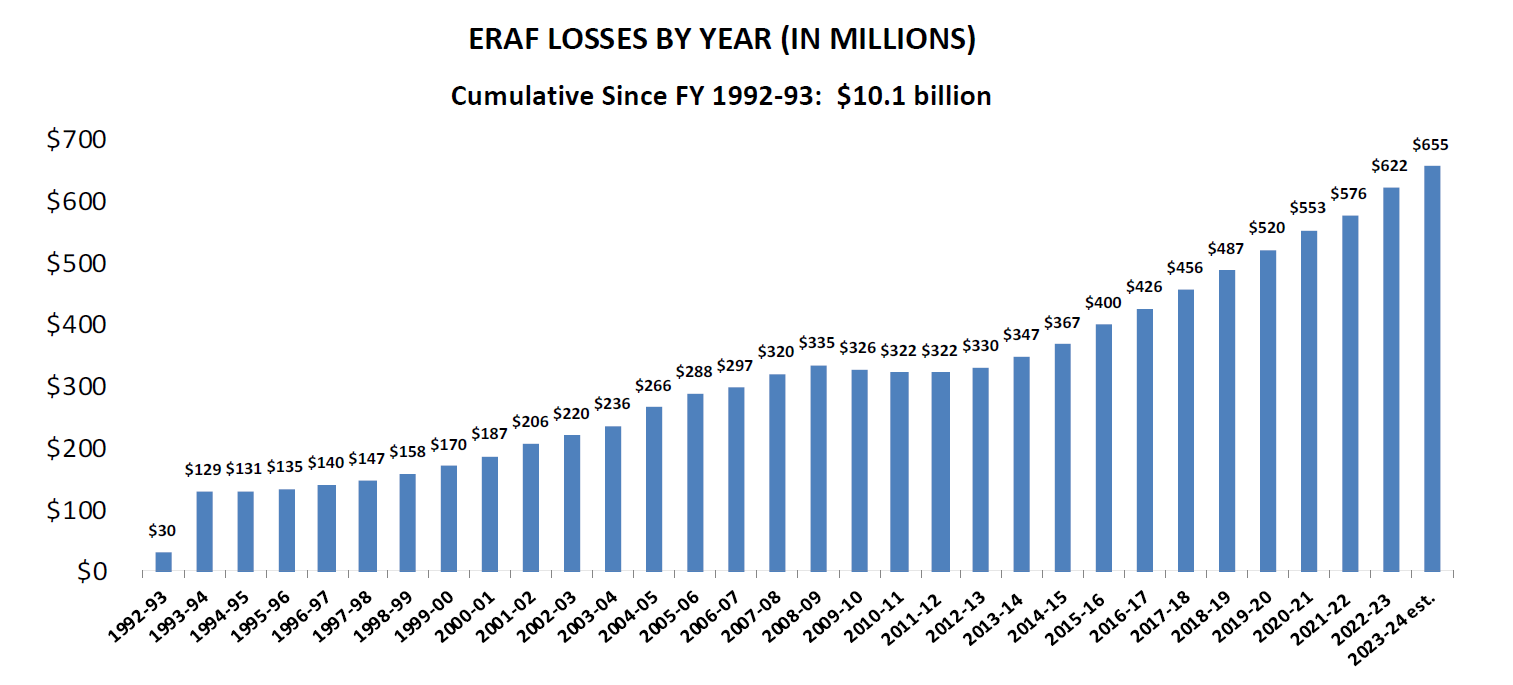

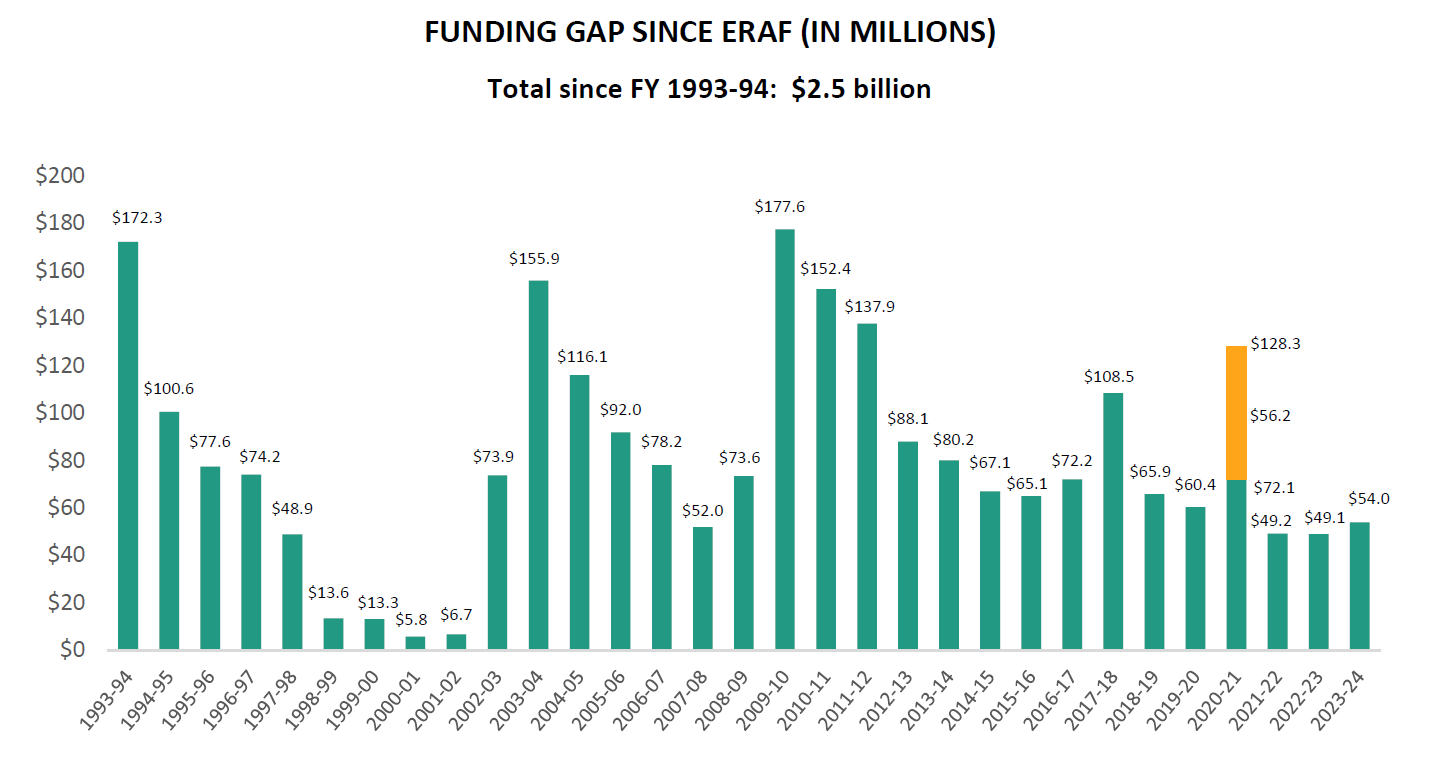

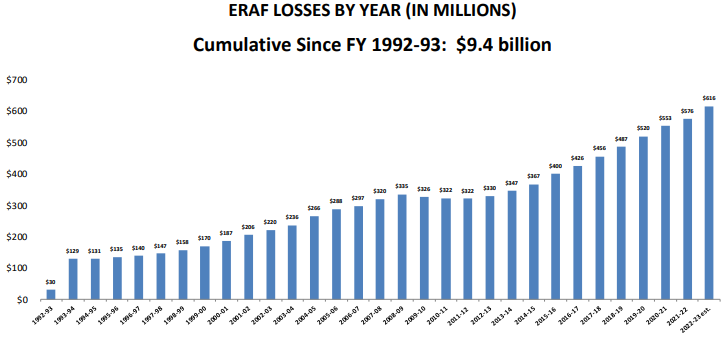

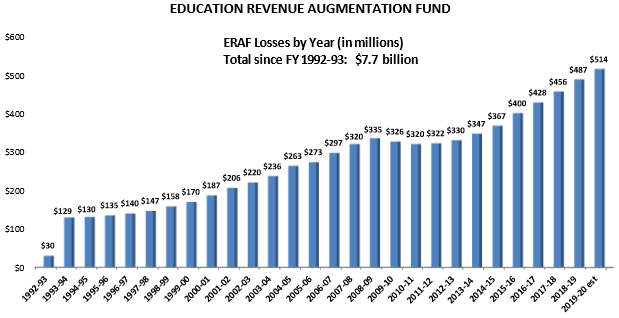

Impact of State Education Revenue Augmentation Fund (ERAF) Property Tax Shift

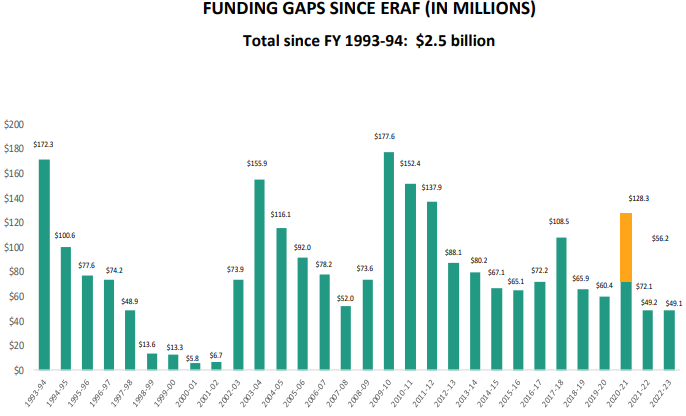

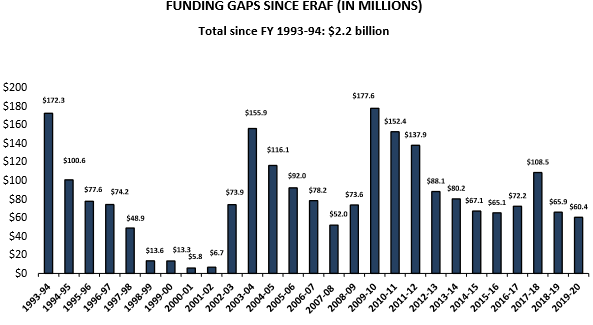

Funding Gap and Balancing Strategies

| Program Area | Net County Cost Reductions (in millions) |

|---|---|

| General Government | $11.2 |

| Health Care | $7.9 |

| Public Assistance | $4.0 |

| Public Protection | $20.8 |

| Countywide Strategies | $10.1 |

| Total | $54.0 |

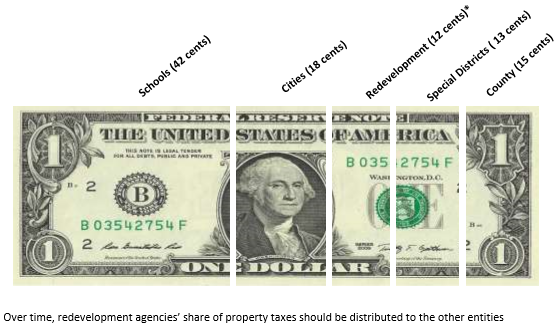

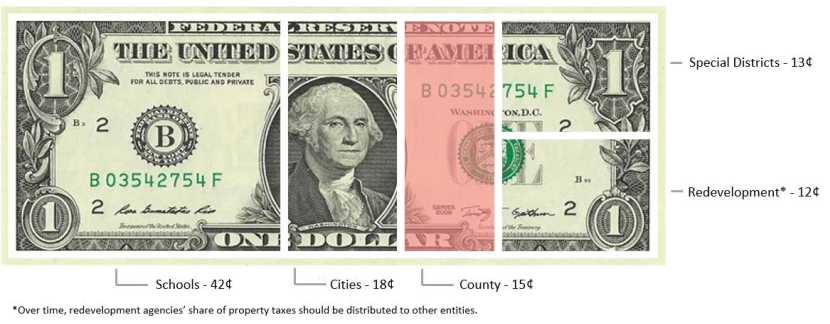

Alameda County Property Tax Dollar

Final Budget

| 2021-22 Final | 2022-23 Final | Change | |

|---|---|---|---|

| All Funds | |||

| Budget | $3,607,949,258 | $3,798,366,989 | $190,417,731 |

| Full Time Equivalent Positions | 10,078.33 | 10,370.33 | 2902.02 |

| General Fund* | |||

| Budget | $3,314,991,846 | $3,489,926,290 | $174,934,444 |

| Full Time Equivalent Positions | 8,210.66 | 8,486.49 | 275.85 |

Appropriations(Expenditures + Contingency + Designation) = TOTAL = Revenue(AFB* + Revenue + Designation Cancellation + Property Taxes)

| Fund | Expenditure Requirements |

Contingency | Designation | Total | AFB* | Miscellaneous Revenue |

Designation Cancellation |

Property Taxes |

|---|---|---|---|---|---|---|---|---|

| General Fund | $3,406.32 | $63.61 | $20.00 | $3,489.93 | $0.00 | $2,890.64 | $31.33 | $567.95 |

| Capital Funds | $61.51 | $0.00 | $0.00 | $61.51 | $17.60 | $43.91 | $0.00 | $0.00 |

| Fish and Game Fund |

$0.06 | $0.00 | $0.00 | $0.06 | $0.00 | $0.06 | $0.00 | $0.00 |

| Road Fund | $115.14 | $0.00 | $0.00 | $115.14 | $45.30 | $69.84 | $0.00 | $0.00 |

| Library Fund | $43.65 | $0.00 | $0.00 | $43.65 | $6.12 | $7.10 | $0.00 | $30.43 |

| Library Special Tax Zone |

$0.63 | $0.00 | $0.00 | $0.63 | $0.00 | $0.01 | $0.00 | $0.62 |

| Property Development Fund |

$40.59 | $0.00 | $0.00 | $40.59 | $0.00 | $40.59 | $0.00 | $0.00 |

| Measure A1 Fund** |

$46.87 | $0.00 | $0.00 | $46.87 | $0.00 | $46.87 | $0.00 | $0.00 |

| Total All Funds | $3,714.76 | $63.61 | $20.00 | $3,798.37 | $69.02 | $3,099.00 | $31.33 | $599.00 |

* Available Fund Balance

** The Measure A1 Affordable Housing General Obligation Bond was approved by voters in 2016 and will provide up to $580 million for affordable housing programs. The final bondsd are expected to be issued in August 2022

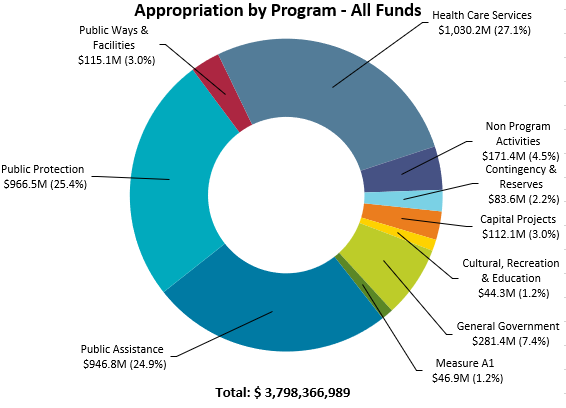

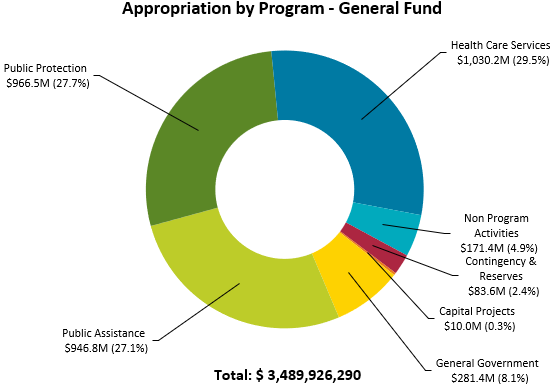

Appropriation by Program

| Program | General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Appropriations | Percent of Total |

|---|---|---|---|---|---|---|---|---|---|---|

| Capital Projects | $10,000,000 | $0 | $0 | $0 | $0 | $40,585,506 | $61,509,660 | $0 | $112,095,166 | 3.0% |

| Cultural, Recreation & Education | $0 | $0 | $0 | $43,653,824 | $626,642 | $0 | $0 | $0 | $44,280,466 | 1.2% |

| General Government | $281,425,129 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $281,425,129 | 7.4% |

| Measure A1 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $46,866,072 | $46,866,072 | 1.2% |

| Public Assistance | $946,817,881 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $946,817,881 | 24.9% |

| Public Protection | $966,476,961 | $60,000 | $0 | $0 | $0 | $0 | $0 | $0 | $966,536,961 | 25.4% |

| Public Ways & Facilities | $0 | $0 | $115,138,995 | $0 | $0 | $0 | $0 | $0 | $115,138,995 | 3.0% |

| Health Care Services | $1,030,216,822 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $1,030,216,822 | 27.1% |

| Non Program Acitvities | $171,383,386 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $171,383,386 | 4.5% |

| Contingency & Reserves | $83,606,111 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $83,606,111 | 2.2% |

| Budget Total | $3,489,926,290 | $60,000 | $115,138,995 | $43,653,824 | $626,642 | $40,585,506 | $61,509,660 | $46,866,072 | $3,798,366,989 | 100.0% |

Appropriation by Major Object

| General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Appropriations | Percent of Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| Salaries & Employee Benefits | $1,493,272.263 | $0 | $17,374,041 | $26,952,820 | $0 | $584,984 | $0 | $0 | $1,538,184,108 | 40.5% |

| Services & Supplies | $1,382,694,601 | $60,000 | $93,859,816 | $14,343,591 | $616,676 | $834,474 | $0 | $46,866,072 | $1,539,275,230 | 40.5% |

| Other Charges | $501,830,278 | $0 | $1,343,138 | $1,357,413 | $9,966 | $0 | $0 | $0 | $504,540,795 | 13.3% |

| Fixed Assets | $7,573,639 | $0 | $1,612,000 | $1,000,000 | $0 | $500,000 | $61,509,660 | $0 | $72,195,299 | 1.90% |

| Intra-Fund Transfer | ($129,463,684) | $0 | ($1,750,000) | $0 | $0 | $0 | $0 | $0 | ($131,213,684) | -3.5% |

| Contingency | $63,606,111 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $63,606,111 | 1.7% |

| Other Financing Uses | $150,413,082 | $0 | $2,700,000 | $0 | $0 | $38,666,048 | $0 | $0 | $191,779,130 | 5.0% |

| Reserve/Designation | $20,000,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $20,000,000 | 0.5% |

| Budget Total | $3,489,926,290 | $60,000 | $115,138,995 | $43,653,824 | $626,642 | $40,585,506 | $61,509,660 | $46,866,072 | $3,798,366,989 | 100% |

Note: Totals may vary slightly due to rounding.

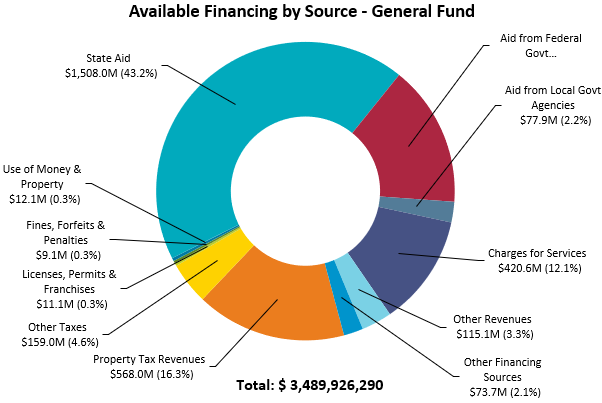

Total Available Financing by Source

| General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Financing | Percent of Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| Property Tax Revenues | $567,952,971 | $0 | $0 | $30,432,794 | $618,292 | $0 | $0 | $0 | $599,004,057 | 15.8% |

| Other Taxes | $158,959,852 | $0 | $10,540,171 | $3,143,428 | $350 | $0 | $0 | $0 | $172,643,801 | 4.5% |

| Licenses, Permits & Franchises | $11,100,663 | $0 | $1,214,376 | $0 | $0 | $0 | $0 | $0 | $12,315,039 | 0.3% |

| Fines, Forfeits & Penalties | $9,132,474 | $59,900 | $25,000 | $0 | $0 | $0 | $0 | $0 | $9,217,374 | 0.2% |

| Use of Money & Property | $12,099,553 | $100 | $3,535,000 | $100,000 | $5,000 | $155,506 | $0 | $0 | $15,895,159 | 0.4% |

| State Aid | $1,508,015,580 | $0 | $52,401,400 | $150,000 | $3,000 | $0 | $31,611,500 | $0 | $1,592,181,480 | 41.9% |

| Aid from Federal Government | $535,320,052 | $0 | $617,000 | $0 | $0 | $0 | $0 | $0 | $535,937,052 | 14.1% |

| Aid from Local Government Agencies | $77,942,778 | $0 | $200,000 | $975,000 | $0 | $0 | $0 | $0 | $79,117,778 | 2.1% |

| Charges for Services | $420,618,471 | $0 | $839,700 | $2,523,696 | $0 | $0 | $0 | $0 | $423,981,867 | 11.2% |

| Other Revenues | $115,093,476 | $0 | $39,200 | $210,000 | $0 | $40,430,000 | $0 | $0 | $155,772,676 | 4.1% |

| Other Financing Sources | $73,690,420 | $0 | $425,000 | $0 | $0 | $0 | $12,294,392 | $46,866,072 | $133,275,884 | 3.5% |

| Available Fund Balance | $0 | $0 | $45,302,148 | $6,118,906 | $0 | $0 | $17,603,768 | $0 | $69,024,822 | 1.8% |

| Budget Total | $3,489,926,290 | $60,000 | $115,138,995 | $43,653,824 | $626,642 | $40,585,506 | $61,509,660 | $46,866,072 | $3,798,366,989 | 100% |

Note: Totals may vary slightly due to rounding.

Discretionary Revenue

Impact of State Education Revenue Augmentation Fund (ERAF) Property Tax Shift

Funding Gap and Balancing Strategies

| Program Area | Net County Cost Reductions (in millions) |

|---|---|

| General Government | $8.0 |

| Health Care | $0.0 |

| Public Assistance | $3.5 |

| Public Protection | $5.5 |

| Countywide Strategies | $32.1 |

| Total | $49.1 |

Alameda County Property Tax Dollar

Final Budget

| 2019-20 Final | 2020-21 Final | Change | |

|---|---|---|---|

| All Funds | |||

| Budget | $3,543,516,165 | $3,513,383,398 | ($30,132,767) |

| Full Time Equivalent Positions | 9,887.01 | 9,963.10 | 76.09 |

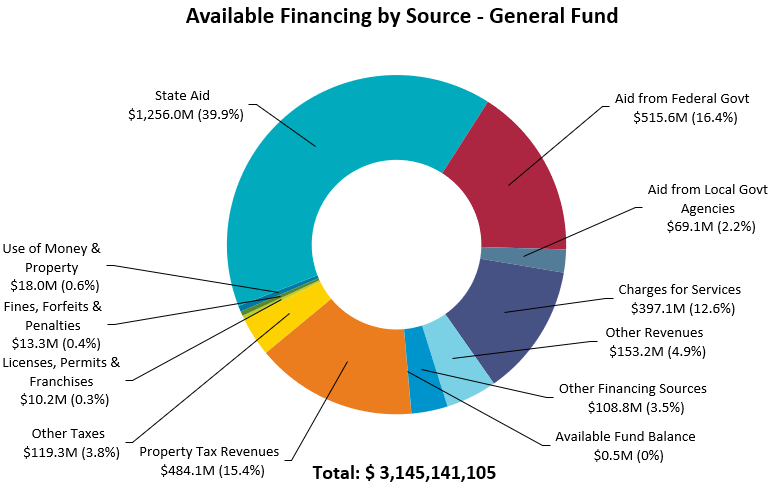

| General Fund* | |||

| Budget | $3,032,211,100 | $3,145,141,105 | $112,930,005 |

| Full Time Equivalent Positions | 7,931.10 | 8,080.70 | 149.60 |

| Fund | Expenditure Requirements |

Contingency | Designation | Total | AFB* | Miscellaneous Revenue |

Designation Cancellation |

Property Taxes |

|---|---|---|---|---|---|---|---|---|

| General Fund | $3,047.60 | $43.61 | $35.08 | $3,126.28 | $0.51 | $2,566.30 | $75.34 | $484.13 |

| Capital Funds | $182.34 | $0.00 | $0.00 | $74.58 | $47.97 | $26.60 | $0.00 | $0.00 |

| Fish and Game Fund |

$0.06 | $0.00 | $0.00 | $0.06 | $0.00 | $0.06 | $0.00 | $0.00 |

| Road Fund | $127.76 | $0.00 | $0.00 | $127.76 | $49.91 | $77.85 | $0.00 | $0.00 |

| Library Fund | $39.96 | $0.00 | $0.00 | $39.96 | $7.47 | $7.75 | $0.00 | $24.74 |

| Library Special Tax Zone |

$0.58 | $0.00 | $0.00 | $0.58 | $0.08 | $0.01 | $0.00 | $0.49 |

| Property Development Fund |

$14.99 | $0.00 | $0.00 | $14.99 | $0.00 | $14.99 | $0.00 | $0.00 |

| Measure A1 Fund |

$28.64 | $0.00 | $0.00 | $28.64 | $0.00 | $28.64 | $0.00 | $0.00 |

| Total All Funds | $3,415.84 | $43.61 | $35.08 | $3,494.52 | $202.61 | $2,707.21 | $75.34 | $509.36 |

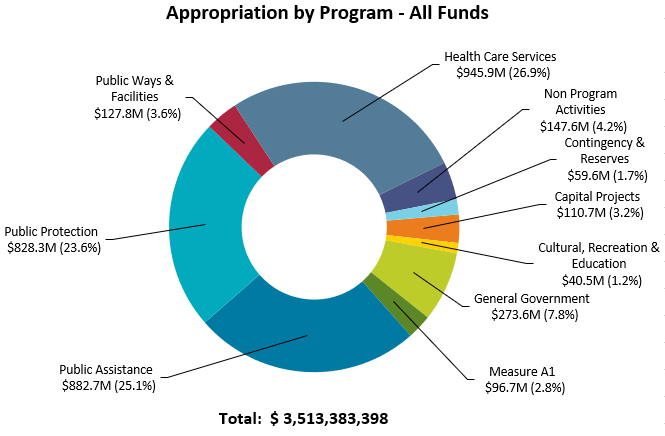

Appropriation by Program

| Program | General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Appropriations | Percent of Total |

|---|---|---|---|---|---|---|---|---|---|---|

| Capital Projects | $7,508,603 | $0 | $0 | $0 | $0 | $28,636,706 | $74,575,422 | $0 | $110,720,731 | 3.2% |

| Cultural, Recreation & Education | $0 | $0 | $0 | $39,955,207 | $575,929 | $0 | $0 | $0 | $40,531,136 | 1.2% |

| General Government | $273,600,725 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $273,600,725 | 7.8% |

| Measure A1 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $96,678,128 | $96,678,128 | 2.8% |

| Public Assistance | $882,745,941 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $882,745,941 | 25.1% |

| Public Protection | $828,196,104 | $60,000 | $0 | $0 | $0 | $0 | $0 | $0 | $828,256,104 | 23.6% |

| Public Ways & Facilities | $0 | $0 | $127,760,901 | $0 | $0 | $0 | $0 | $0 | $127,760,901 | 3.6% |

| Health Care Services | $945,905,615 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $945,905,615 | 26.9% |

| Non Program Acitvities | $147,598,006 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $147,598,006 | 4.2% |

| Contingency & Reserves | $59,586,111 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $59,586,111 | 1.7% |

| Budget Total | $3,145,141,105 | $60,000 | $127,760,90 | $39,955,207 | $597,929 | $28,636,706 | $74,575,422 | $96,678,128 | $3,513,383,398 | 100.0% |

Appropriation by Major Object

| General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Appropriations | Percent of Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| Salaries & Employee Benefits | $1,288,628,001 | $0 | $16,116,365 | $25,007,161 | $0 | $540,100 | $0 | $0 | $1,330,291,627 | 37.9% |

| Services & Supplies | $1,238,963,093 | $60,000 | $107,925,855 | $13,848,017 | $566,392 | $1,351,599 | $0 | $96,678,128 | $1,459,393,084 | 41.5% |

| Other Charges | $501,904,633 | $0 | $1,552,681 | $912,029 | $9,537 | $0 | $0 | $0 | $504,378,880 | 14.4% |

| Fixed Assets | $12,940,843 | $0 | $1,501,000 | $188,000 | $0 | $125,000 | $73,631,761 | $0 | $88,386,604 | 2.4% |

| Intra-Fund Transfer | ($86,044,722) | $0 | ($1,935,000) | $0 | $0 | $0 | $0 | $0 | ($87,979,722) | -2.5% |

| Contingency | $43,606,111 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $43,606,111 | 1.2% |

| Other Financing Uses | $110,063,146 | $0 | $2,600,000 | $0 | $0 | $26,620,007 | $943,661 | $0 | $140,226,814 | 4.0% |

| Reserve/Designation | $35,080,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $35,080,000 | 1.0% |

| Budget Total | $3,145,141,105 | $60,000 | $127,760,901 | $39,955,207 | $575,929 | $28,636,706 | $74,575,422 | $96,678,128 | $3,513,383,398 | 100% |

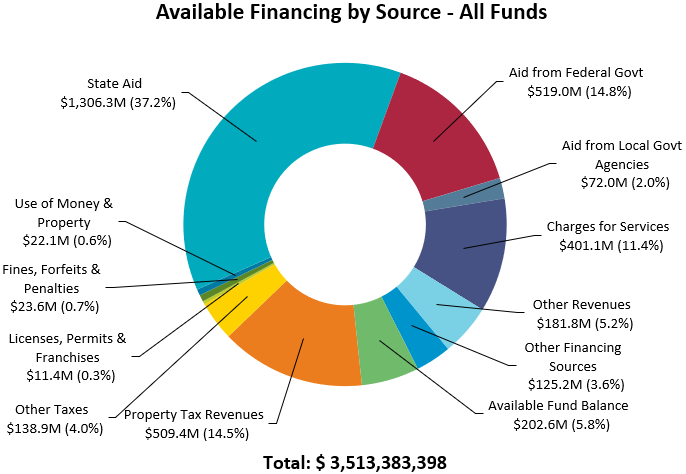

Total Available Financing by Source

| General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Financing | Percent of Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| Property Tax Revenues | $484,128,919 | $0 | $0 | $24,737,292 | $492,258 | $0 | $0 | $0 | $509,358,469 | 14.5% |

| Other Taxes | $119,667,709 | $0 | $16,381,626 | $3,216,083 | $350 | $0 | $0 | $0 | $138,865,768 | 4.0% |

| Licenses, Permits & Franchises | $10,176,636 | $0 | $1,246,653 | $0 | $0 | $0 | $0 | $0 | $11,423,289 | 0.3% |

| Fines, Forfeits & Penalties | $13,321,714 | $59,900 | $25,000 | $0 | $0 | $0 | $10,200,000 | $0 | $23,606,614 | 0.7% |

| Use of Money & Property | $18,029,029 | $100 | $3,725,000 | $100,000 | $5,000 | $236,706 | $0 | $0 | $22,095,835 | 0.6% |

| State Aid | $1,255,986,490 | $0 | $50,047,661 | $240,000 | $3,000 | $0 | $0 | $0 | $1,306,277,151 | 37.2% |

| Aid from Federal Government | $515,582,572 | $0 | $3,422,005 | $0 | $0 | $0 | $0 | $0 | $519,004,577 | 14.8% |

| Aid from Local Government Agencies | $69,077,733 | $0 | $1,964,000 | $975,000 | $0 | $0 | $0 | $0 | $72,016,733 | 2.0% |

| Charges for Services | $397,055,633 | $0 | $996,700 | $3,009,338 | $0 | $0 | $0 | $0 | $401,061,671 | 11.4% |

| Other Revenues | $153,187,710 | $0 | $39,200 | $210,000 | $0 | $28,400,000 | $0 | $0 | $181,836,910 | 5.2% |

| Other Financing Sources | $108,818,357 | $0 | $0 | $0 | $0 | $0 | $16,403,770 | $0 | $125,222,127 | 3.6% |

| Available Fund Balance | $508,603 | $0 | $49,913,056 | $7,467,494 | $75,321 | $0 | $47,971,652 | $96,678,128 | $202,614,254 | 5.8% |

| Budget Total | $3,145,141,105 | $60,000 | $127,760,901 | $39,955,207 | $575,929 | $28,636,706 | $74,575,422 | $96,678,128 | $3,513,383,398 | 100% |

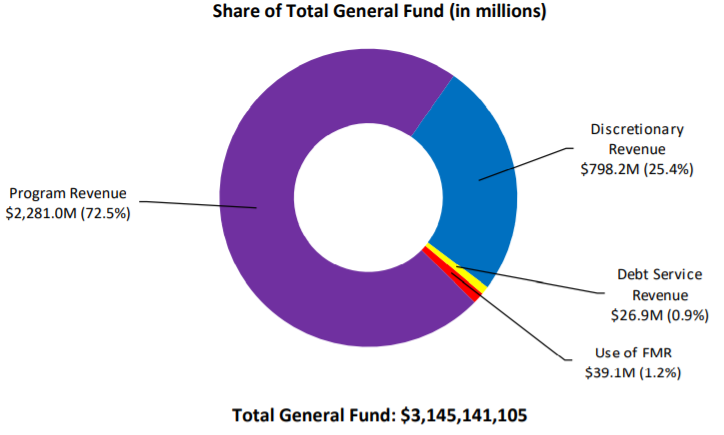

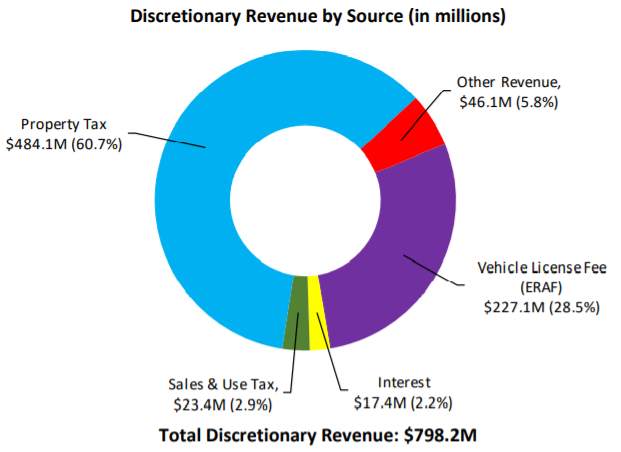

Discretionary Revenue

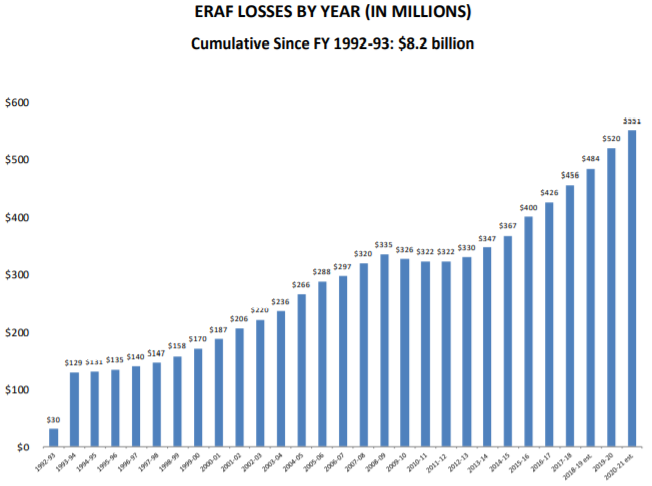

Impact of State Education Revenue Augmentation Fund (ERAF) Property Tax Shift

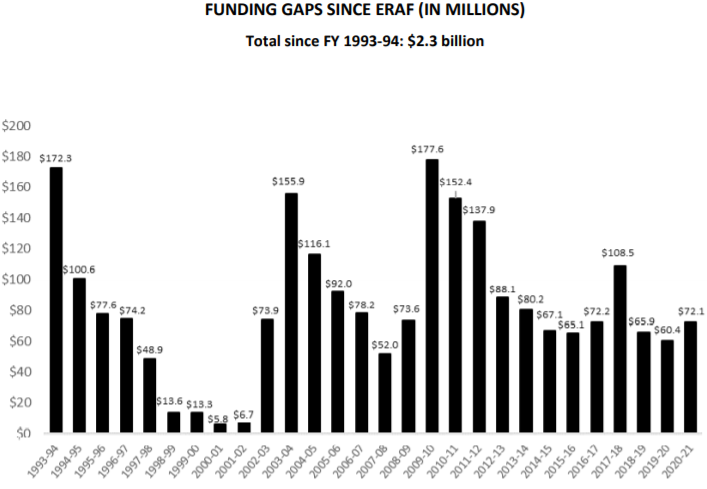

Funding Gap and Balancing Strategies

| Program Area | Net County Cost Reductions (in millions) |

|---|---|

| General Government | $17.7 |

| Health Care | $20.5 |

| Public Assistance | $2.9 |

| Public Protection | $31.0 |

| Total | $72.10 |

| Program Area | Use of FMR (in millions) |

|---|---|

| General Government | $17.7 |

| Health Care | $11.4 |

| Public Assistance | $0.0 |

| Public Protection | $10.0 |

| Total | $39.1 |

| Program Area | Appropriation Decrease | Revenue Increase | Use of FMR | Total Reduction Including FMR |

FTE Reduction |

|---|---|---|---|---|---|

| General Government | $0.0 | $0.0 | $17.7 | $17.7 | 0.00 |

| Health Care | $3.9 | $6.6 | $10.0 | $20.5 | 0.00 |

| Public Assistance | $4.5 | ($1.6) | $0.0 | $2.9 | (11.71) |

| Public Protection | $5.0 | $14.6 | $11.4 | $31.0 | 7.00 |

| Grand Total | $13.4 | $19.6 | $39.1 | $72.1 | (11.71) |

Alameda County Property Tax Dollar

Final Budget

| 2018-19 Final | 2019-20 Final | Change | |

|---|---|---|---|

| All Funds | |||

| Budget | $3,415,539,736 | $3,543,516,165 | $127,976,429 |

| Full Time Equivalent Positions | 9,7651.45 | 9,887.00 | 125.55 |

| General Fund* | |||

| Budget | $2,889,682,765 | $3,032,211,100 | $142,528,335 |

| Full Time Equivalent Positions | 7,801.46 | 7,931.10 | 129.64 |

* General Fund includes Grants and Measure A

| Fund | Expenditure Requirements |

Contingency | Designation | Total | AFB* | Miscellaneous Revenue |

Designation Cancellation |

Property Taxes |

|---|---|---|---|---|---|---|---|---|

| General Fund | $2,954.12 | $43.61 | $34.48 | $3,032.21 | $1.09 | $2,499.68 | $47.31 | $484.13 |

| Capital Funds | $182.34 | $0.00 | $0.00 | $182.34 | $51.64 | $82.68 | $48.02 | $0.00 |

| Fish and Game Fund |

$0.06 | $0.00 | $0.00 | $0.06 | $0.00 | $0.06 | $0.00 | $0.00 |

| Road Fund | $121.18 | $0.00 | $0.00 | $121.18 | $26.78 | $94.40 | $0.00 | $0.00 |

| Library Fund | $36.00 | $0.00 | $0.00 | $36.00 | $3.54 | $7.72 | $0.00 | $24.74 |

| Library Special Tax Zone |

$0.60 | $0.00 | $0.00 | $0.60 | $0.08 | $0.03 | $0.00 | $0.49 |

| Property Development Fund |

$14.99 | $0.00 | $0.00 | $14.99 | $0.00 | $14.99 | $0.00 | $0.00 |

| Measure A1 Fund |

$156.14 | $0.00 | $0.00 | $156.14 | $156.14 | $0.00 | $0.00 | $0.00 |

| Total All Funds | $3,465.43 | $43.61 | $34.48 | $3,543.52 | $239.27 | $2,699.56 | $95.33 | $509.36 |

* Available Fund Balance

Note: Table reads to the center; total appropriations (columns 2, 3, and 4) equal total revenues (the last four columns).

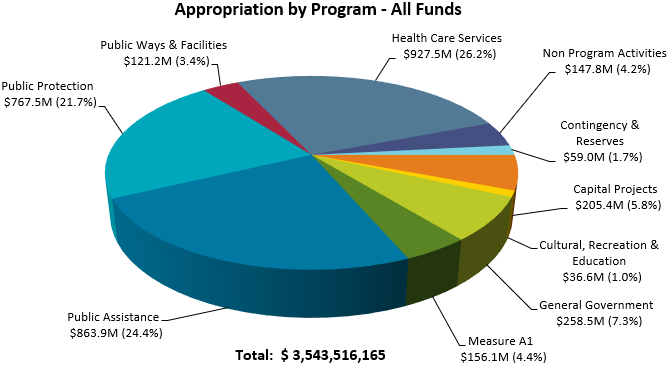

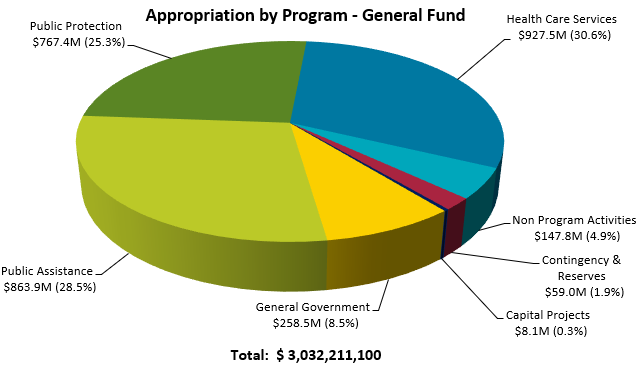

Appropriation by Program

| Program | General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Appropriations | Percent of Total |

|---|---|---|---|---|---|---|---|---|---|---|

| Capital Projects | $8,093,145 | $0 | $0 | $0 | $0 | $14,986,706 | $182,341,703 | $0 | $205,421,554 | 5.8% |

| Cultural, Recreation & Education | $0 | $0 | $0 | $36,002,653 | $575,929 | $0 | $0 | $0 | $36,600,582 | 1.0% |

| General Government | $258,494,745 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $258,494,745 | 7.3% |

| Measure A1 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $156,135,608 | $156,135,608 | 4.4% |

| Public Assistance | $863,906,394 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $863,906,394 | 24.4% |

| Public Protection | $767,449,670 | $60,000 | $0 | $0 | $0 | $0 | $0 | $0 | $767,449,670 | 21.7% |

| Public Ways & Facilities | $0 | $0 | $121,180,466 | $0 | $0 | $0 | $0 | $0 | $121,180,466 | 3.4% |

| Health Care Services | $927,468,774 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $927,468,774 | 26.2% |

| Non Program Acitvities | $147,812,261 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $147,812,261 | 4.2% |

| Contingency & Reserves | $58,986,111 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $58,986,111 | 1.7% |

| Budget Total | $3,032,211,100 | $60,000 | $121,180,466 | $36,002,653 | $597,929 | $14,986,706 | $182,341,703 | $156,135,608 | $3,543,516,165 | 100.0% |

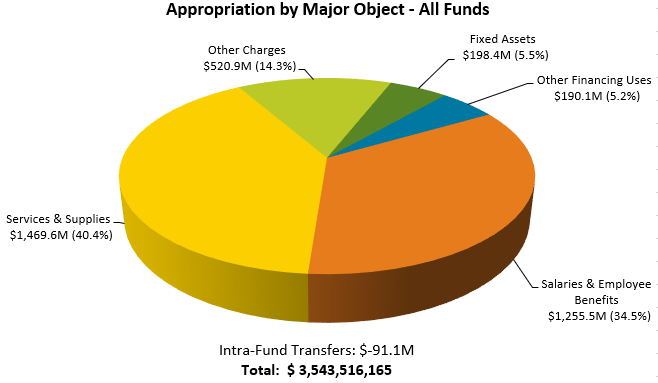

Appropriation by Major Object

| General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Appropriations | Percent of Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| Salaries & Employee Benefits | $1,215,330,878 | $0 | $15,740,000 | $23,945,120 | $0 | $524,891 | $0 | $0 | $1,255,540,889 | 35.4% |

| Services & Supplies | $1,198,863,657 | $60,000 | $101,752,306 | $10,889,762 | $591,960 | $1,346,041 | $0 | $156,135,608 | $1,469,639,334 | 41.5% |

| Other Charges | $518,857,377 | $0 | $1,015,160 | $979,771 | $5,969 | $0 | $0 | $0 | $520,858,277 | 14.7% |

| Fixed Assets | $14,479,193 | $0 | $1,673,000 | $188,000 | $0 | $125,000 | $181,923,124 | $0 | $198,388,317 | 5.6% |

| Intra-Fund Transfer | ($89,757,539) | $0 | ($1,300,000) | $0 | $0 | $0 | $0 | $0 | ($91,057,539) | -2.6% |

| Contingency | $43,606,111 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $43,606,111 | 1.2% |

| Other Financing Uses | $96,351,423 | $0 | $2,300,000 | $0 | $0 | $12,990,774 | $418,579 | $0 | $112,060,776 | 3.2% |

| Reserve/Designation | $34,480,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $34,480,000 | 1.0% |

| Budget Total | $3,032,211,100 | $60,000 | $121,180,466 | $36,002,653 | $597,929 | $14,986,706 | $182,341,703 | $156,135,608 | $3,543,516,165 | 100% |

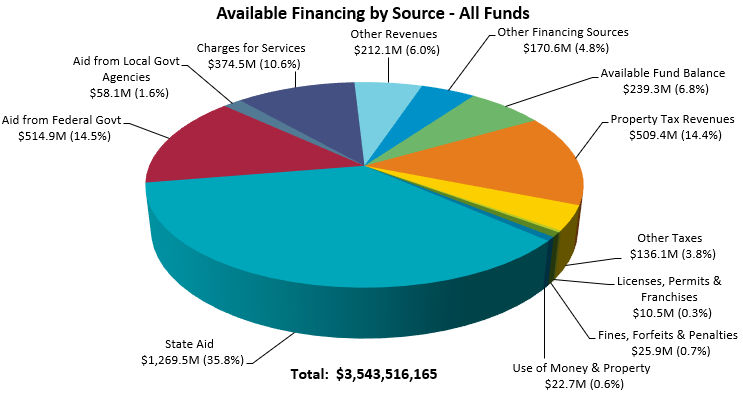

Total Available Financing by Source

| General Fund | Fish & Game Fund | Road Fund | Library Fund | Library Special Tax Zone | Property Development Fund | Capital Funds | Measure A1 Fund | Total Financing | Percent of Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| Property Tax Revenues | $484,128,919 | $0 | $0 | $24,737,292 | $492,25 | $0 | $0 | $0 | $509,358,469 | 14.4% |

| Other Taxes | $119,267,709 | $0 | $13,169,934 | $3,216,083 | $350 | $0 | $0 | $0 | $136,054,076 | 3.8% |

| Licenses, Permits & Franchises | $9,364,877 | $0 | $1,151,660 | $0 | $0 | $0 | $0 | $0 | $10,516,537 | 0.3% |

| Fines, Forfeits & Penalties | $12,450,701 | $59,900 | $25,000 | $0 | $0 | $0 | $13,403,690 | $0 | $25,939,291 | 0.7% |

| Use of Money & Property | $19,297,297 | $100 | $3,060,000 | $100,000 | $5,000 | $236,706 | $0 | $0 | $22,699 | 0.6% |

| State Aid | $1,221,073,65 | $0 | $47,955,770 | $240,000 | $25,000 | $0 | $215,765 | $0 | $1,269,510,186 | 35.8% |

| Aid from Federal Government | $509,731,507 | $0 | $5,155,745 | $0 | $0 | $0 | $0 | $0 | $514,887,252 | 14.5% |

| Aid from Local Government Agencies | $34,015,216 | $0 | $23,060,000 | $975,000 | $0 | $0 | $0 | $0 | $58,050,216 | 1.6% |

| Charges for Services | $370,734,483 | $0 | $808,700 | $2,980,291 | $0 | $0 | $0 | $0 | $374,523,474 | 10.6% |

| Other Revenues | $197,126,105 | $0 | $14,200 | $210,000 | $0 | $14,750,000 | $0 | $0 | $212,100,305 | 6.0% |

| Other Financing Sources | $53,527,490 | $0 | $0 | $0 | $0 | $0 | $117,083,382 | $0 | $170,610,872 | 4.8% |

| Available Fund Balance | $1,093,145 | $0 | $26,779,457 | $3,543,987 | $75,321 | $0 | $51,638,866 | $156,135,608 | $239,266,384 | 6.8% |

| Budget Total | $3,032,211,100 | $60,000 | $121,180,466 | $36,002,653 | $14,986,706 | $182,341,703 | $156,135,608 | $236,380,274 | $3,543,516,165 | 100% |

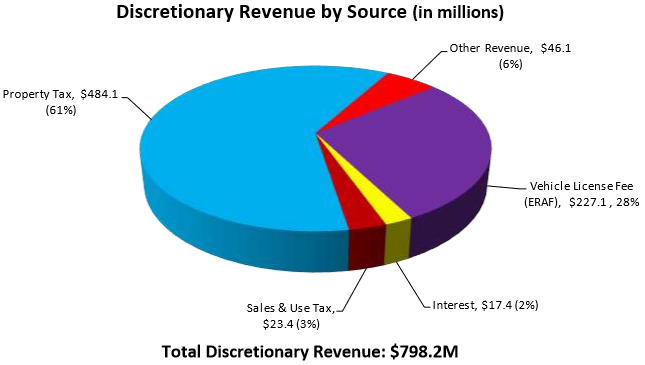

Discretionary Revenue

Impact of State Education Revenue Augmentation Fund (ERAF) Property Tax Shift

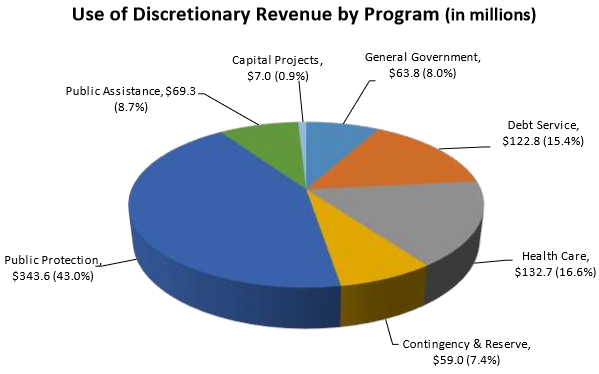

Funding Gap and Balancing Strategies

| Program Area | Net County Cost Reductions (in millions) |

|---|---|

| General Government | $19.0 |

| Health Care | $12.0 |

| Public Assistance | $12.3 |

| Public Protection | $13.2 |

| Non-Program Revenue | $3.9 |

| Total | $60.4 |

| Proposed Budget Balancing Strategies | Net County Cost Reductions (in millions) |

|---|---|

| Ongoing Strategies | |

| Program appropriation reductions | $16.3 |

| Program revenue increases | $5.0 |

| Non-Program revenue increases | $3.9 |

| Subtotal Ongoing Strategies | $25.2 |

| One-Time Strategies | |

| Fiscal Management Savings | $28.8 |

| One-time revenues | $6.4 |

| Subtotal One-Time Strategies | $35.2 |

| Grand Total Balancing Strategies | $60.4 |

| Program Area | Use of FMR (in millions) |

|---|---|

| General Government | $17.8 |

| Health Care | $7.0 |

| Public Assistance | $0.0 |

| Public Protection | $4.0 |

| Total | $28.8 |

| Program Area | Appropriation Decrease | Revenue Increase | Use of FMR | Total Reduction Including FMR |

FTE Reduction |

|---|---|---|---|---|---|

| General Government | $0.2 | $1.0 | $17.9 | $19.0 | 0.00 |

| Health Care | $0.3 | $4.7 | $7.0 | $12.0 | 0.00 |

| Public Assistance | $10.9 | $1.4 | $0.0 | $12.3 | 0.00 |

| Public Protection | $4.8 | $4.3 | $4.0 | $13.2 | 7.00 |

| Program Total | $16.2 | $11.4 | $28.8 | $56.5 | 7.00 |

| Countywide Strategies | $0.0 | $3.9 | $0.0 | $3.9 | 0.00 |

| Grand Total | $16.2 | $15.3 | $28.8 | $60.4 | 7.00 |

Alameda County Property Tax Dollar